Blog

China Recovery as a Prediction Model for the U.S. and Europe

Published June 22, 2020 by Patrick Trice

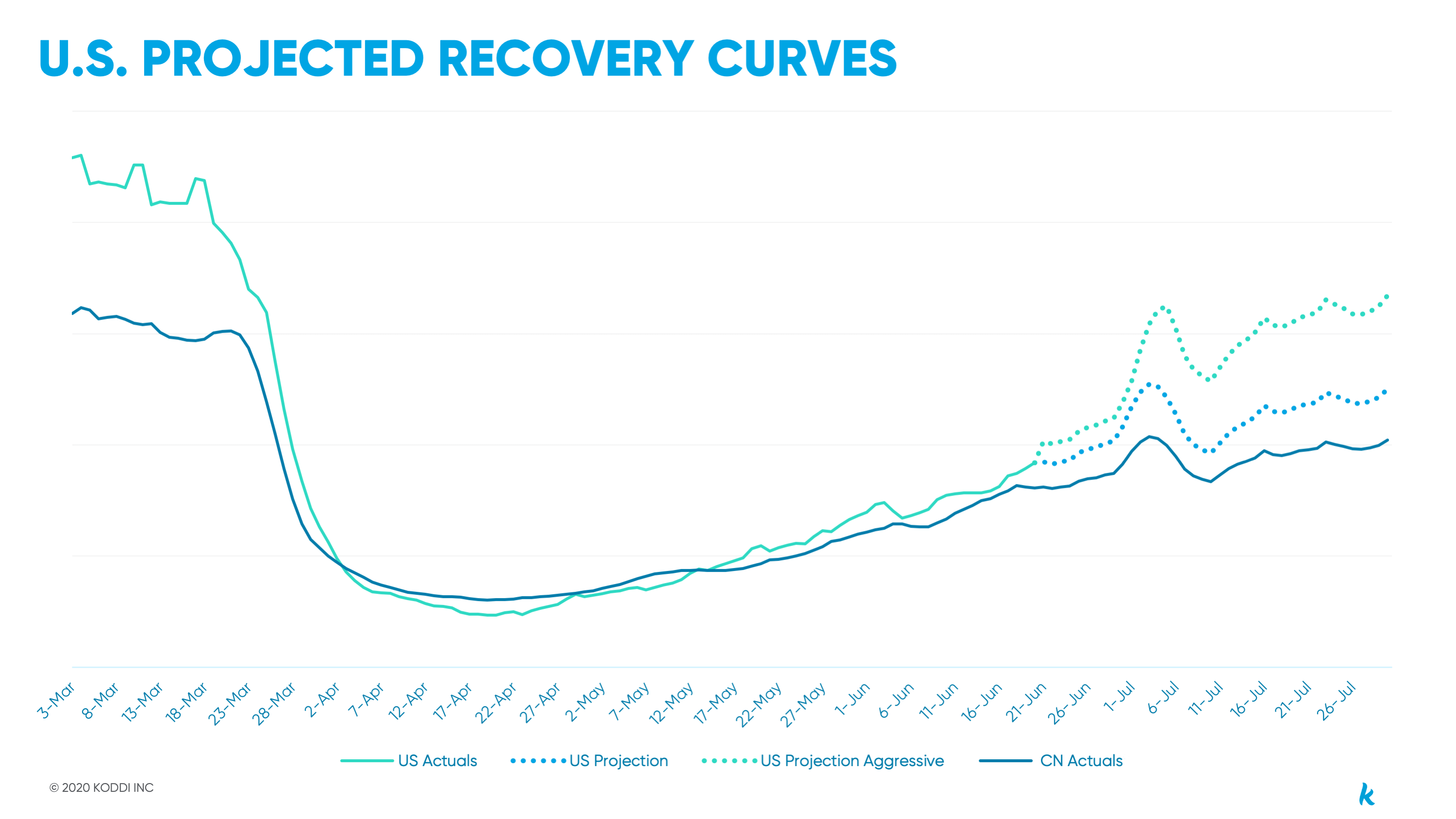

Countries like China, who first weathered the coronavirus, continue to show positive signs of recovery following relief from lockdowns. As the initial epicenter of the COVID-19 outbreak, China trends could serve as a projection model for phased recovery around the world. Back in late February, travel demand for China began to see an increase following the outbreak of COVID-19. Since this turning point, demand has held stable with China seeing consistent growth week-over-week. Koddi has continued to monitor this ongoing upward trend in traveler demand in China (in partnership with Shiji Distribution Solutions) and developed models on how this could inform potential recovery in other regions.

Leveraging China Learnings for U.S. Recovery

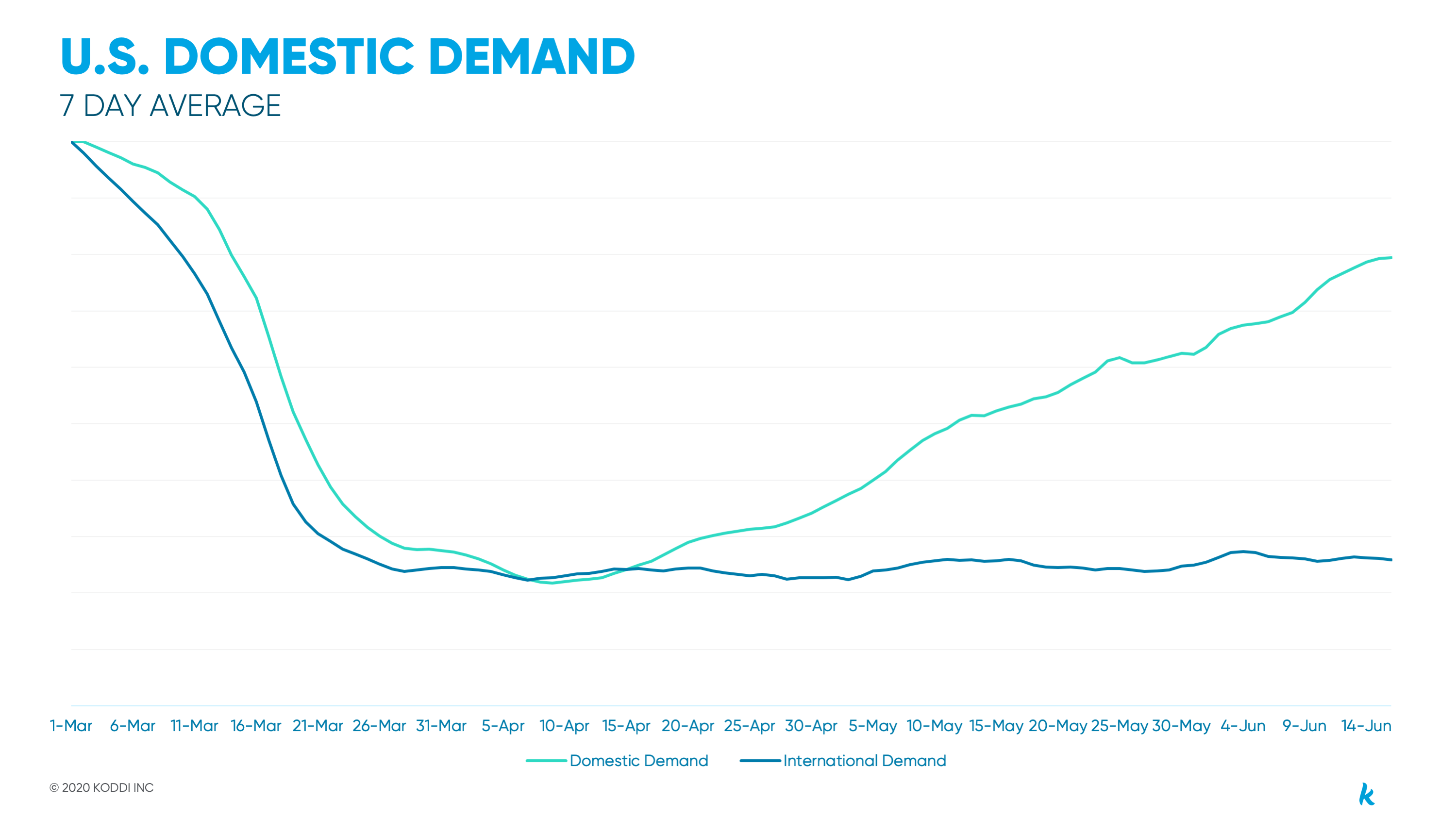

In early March, the United States declared a state of national emergency due to COVID-19, spurring a swift decline in U.S. travel demand. In the weeks since, we’ve observed a turnaround with consistent week-over-week growth, indicating travel is making a resurgence.

- Domestic travel represented more than 96% of the total available demand in May and June to date. Should travel restrictions continue to remain in effect, it’s likely that domestic demand will continue to be the only segment that will not see depressed recovery.

- International travel is stabilizing; however, it’s important to note that international travel restrictions to the U.S. for non-U.S. citizens are still in place for many countries.

- More than half of the states in the U.S. have partially reopened after lifting shelter-in-place orders, making interstate travel more feasible for U.S. travelers.

- With Memorial Day in May and the upcoming 4th of July holiday, demand has seen steady increases early this summer (particularly for long holiday weekends).

- As we continue further into the summer months, it’s likely that leisure travel will account for the majority, if not a large portion, of the domestic demand growth (particularly for beaches and other outdoor destinations).

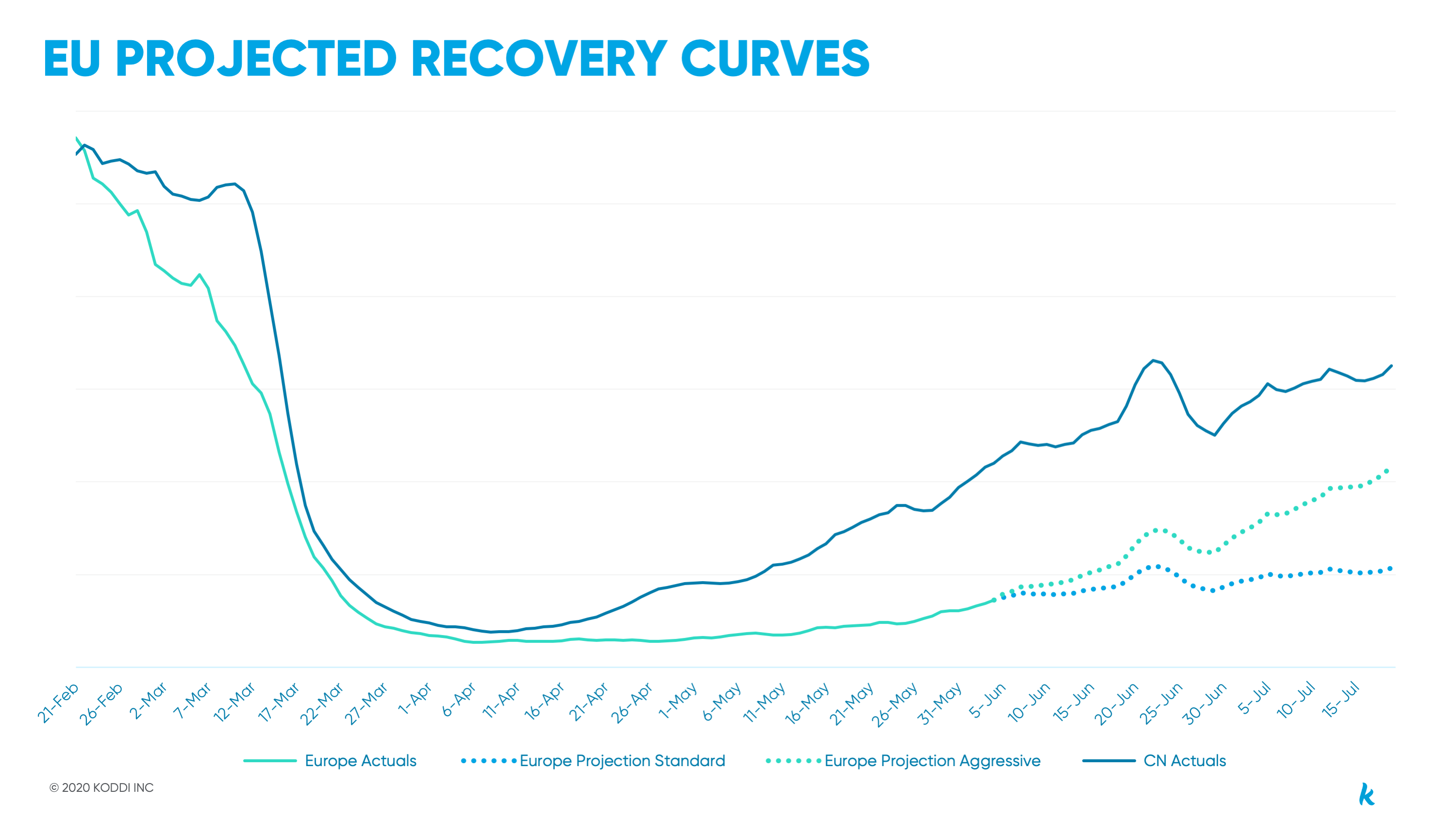

Leveraging China Learnings for Europe Recovery

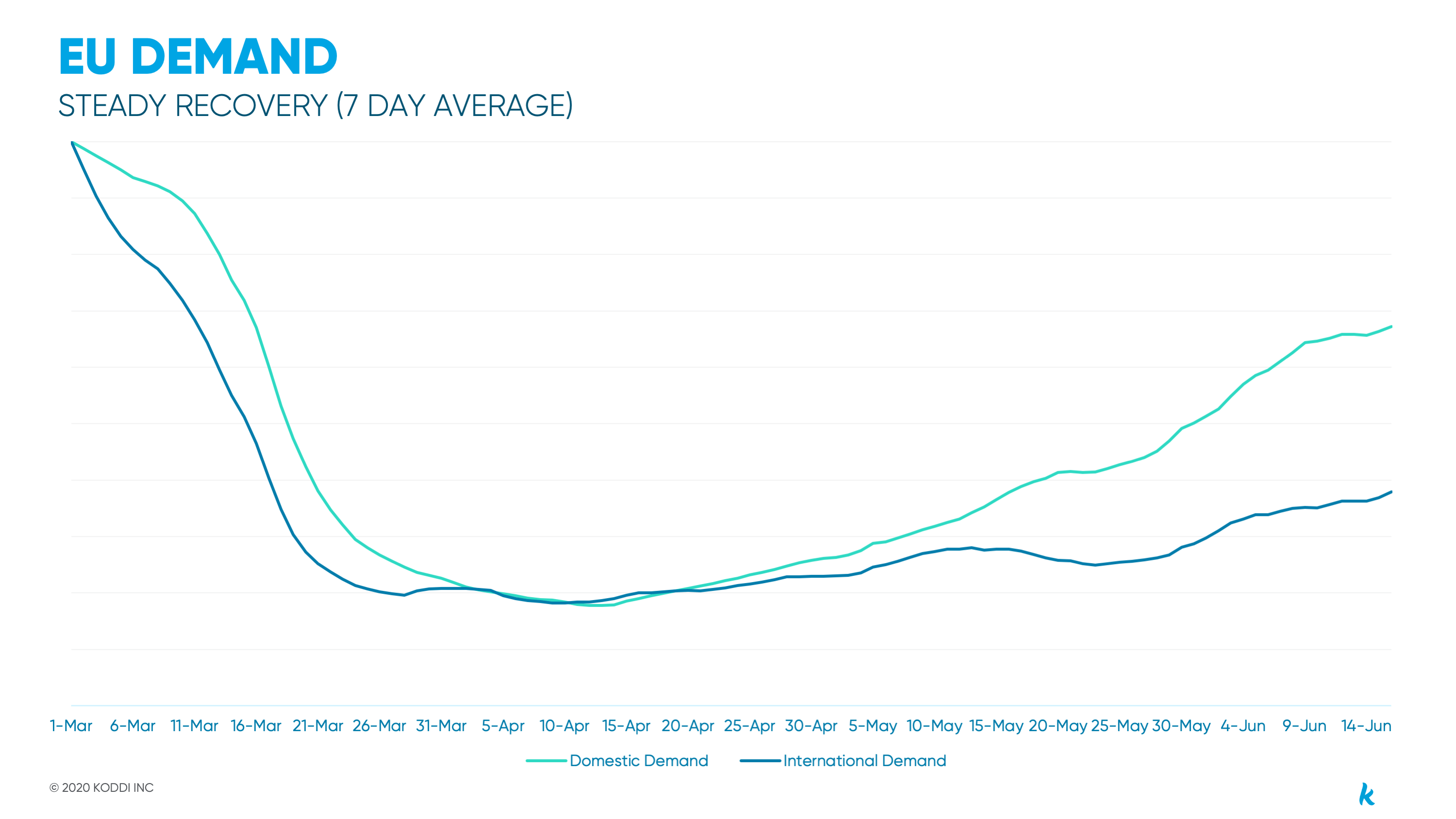

Ongoing developments within European markets will be important to monitor, as some of the heaviest travel restrictions are present across Europe. As a result, both domestic and international travel came to a near halt in March. Fortunately, similar to China, we are now seeing a pivot with domestic demand exhibiting sustained growth through May and into early June.

- While domestic demand represents the majority of available opportunity, both international and domestic travel have seen positive growth since Easter Sunday (4/12).

- The positive shift has remained relatively stable into early June, but with border closures still in effect and limited incentive for international travel due to remaining “shelter-in-place” orders, we expect domestic travel to recover first.

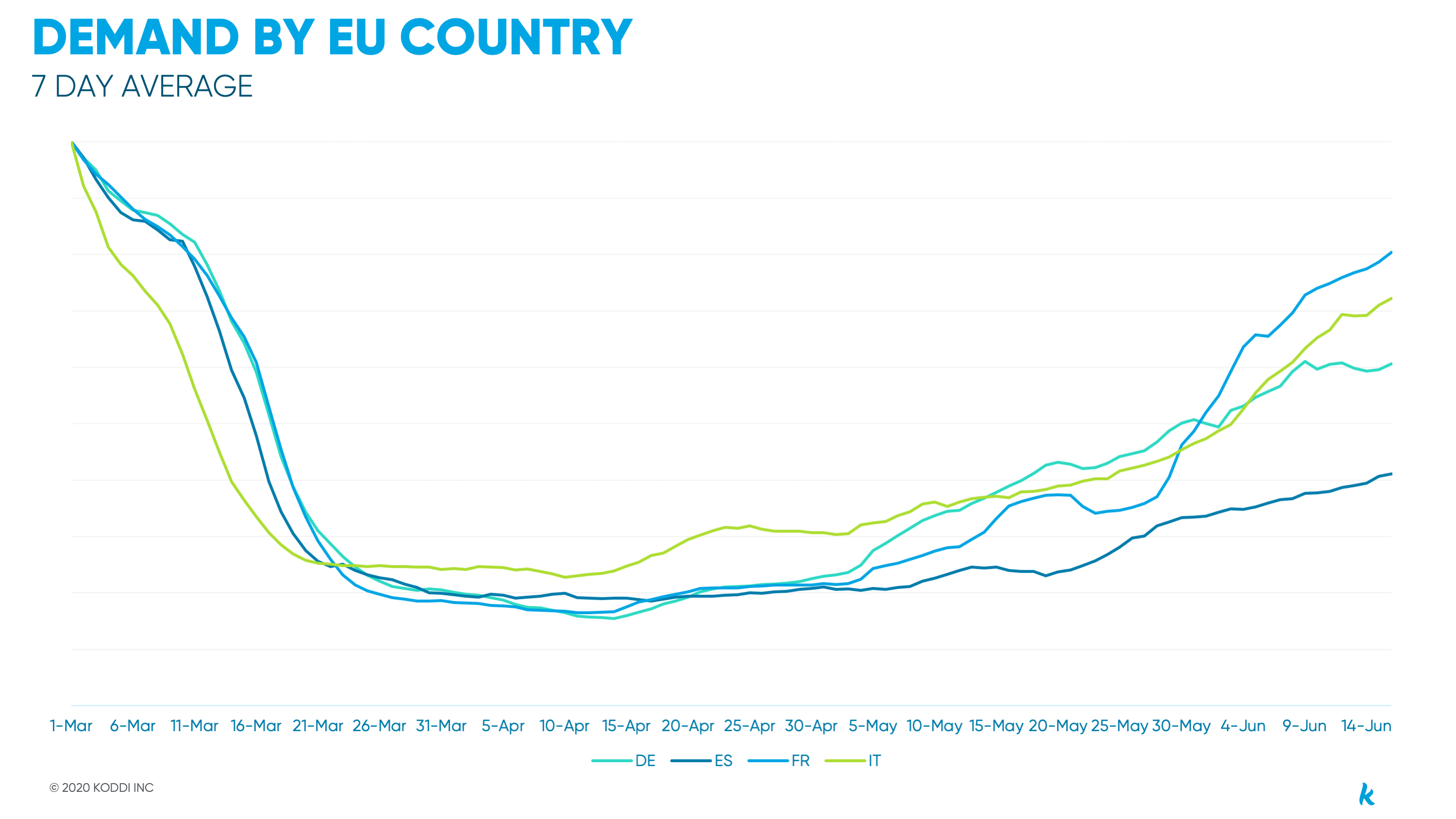

- These small upticks in demand continued as Italy and Spain, followed by France, released early “shelter-in-place” restrictions in May. We expect small uptakes in international demand as countries continue to open up travel across the EU and Schengen Region. Additional border openings include Malta (July 1), Portugal (July 1), and Spain (June 21).

- Consistent with what we’re seeing globally, recovery will happen gradually – city by city, state by state and country by country.

- In Europe, we are now seeing signs of recovery happening across major markets, with small but steady growth since mid to late April.

- Easter Sunday marked the first significant uptick in demand for European markets, and since that initial uptick, we have continued to observe WoW growth in the weeks following.

- Overall demand is continuing to trend upward at an exponential rate, largely due to domestic travel which contributed to roughly three-quarters of the additional searches.

- We will continue to monitor if this behavior holds throughout June and July, as many of these countries are releasing restrictions on international travel within the region.

Projecting Recovery Curves By Region

Modeled after the behavior we see in China, Koddi has developed two potential projection paths that the U.S. and European markets could take:

- Standard Recovery: Similar to China, we see a lag in demand as the market stabilizes while COVID-19 cases across the country reach their apex. As states begin lifting their shelter-in-place orders, we anticipate a steady uplift through June, eventually approaching pre-COVID levels headed into 2021.

- Aggressive Recovery: In this model, a similar lag period persists through early May, however towards the tail-end of the month, overall demand sees a sharper spike. Perceiving a potential stronger shift in consumer behavior, demand could significantly outpace the standard model during the second half of the year, as users are more comfortable with shopping for both leisure and business travel as a recovering market seeks travel options post quarantine restrictions.

Looking Ahead

As initial “shelter-in-place” orders come to a close, some businesses are beginning to cautiously reopen their doors, hotels included. This is spurring positive growth in terms of travel demand, but continued monitoring is critical. With health officials warning of a potential second wave of COVID-19, as seen in APAC regions, these projections could rapidly shift if precautionary measures are not taken. Koddi continues to actively monitor the market on both a macro and micro level to provide insights and early learnings around key indicators of major market shifts. To stay up to date with all new insights, subscribe to our blog.

You may be interested in

GET IN TOUCH

Ready to get started?

Don’t let your brand get lost in the noise. Partner with Koddi to unlock the power of commerce media and transform the way you engage with your customers. Our team of experts is here to help you navigate complexities and develop a strategy that drives results — no matter what industry – in as little as 45 days.